Understanding Ritenuta d’Acconto in Italy

If you’re working as a freelancer, consultant, or service provider in Italy, there’s a good chance you’ve encountered the term ritenuta d’acconto. For many professionals—especially

If you’re working as a freelancer, consultant, or service provider in Italy, there’s a good chance you’ve encountered the term ritenuta d’acconto. For many professionals—especially

A contratto a tempo determinato, or fixed-term contract, is a popular type of employment arrangement in Italy that provides flexibility to employers while offering specific

Italy has positioned itself as a global leader in the world of electronic invoicing, or fatturazione elettronica, by making it mandatory for most businesses operating

Fisconline is an essential digital platform created by the Italian Revenue Agency (Agenzia delle Entrate) to facilitate the management of tax obligations for both individuals

How to open an Italian current account? To open a bank account you must be at least eighteen years of age, be in possession of

When deciding whether to open a Società a Responsabilità Limitata (SRL, basically a LLC) or an Associazione (Association which is basically a non-profit organization) in

In Italy, the Certificate of Habitability (Certificato di Agibilità) is a critical document that certifies a property’s compliance with safety, hygiene, health, and energy-saving standards

Buying property in Puglia, Italy, can be an exciting venture, but it requires careful navigation through the region’s legal and bureaucratic landscape. From initial due

In the sun-drenched region of Puglia, Italy, a hidden gem of olive groves, whitewashed trulli houses, and stunning coastlines, prospective property buyers often find themselves

In Italy, the process of purchasing real estate involves distinct yet often confused stages: the offer to purchase (proposta di acquisto) and the preliminary sales

In the realm of Southern Italian real estate transactions, particularly in regions like Puglia, the compromesso contract (preliminary sales agreement) often plays a pivotal role.

The Italian government offers a program called the “Lavoratori Impatriarti” regime to attract and retain highly skilled workers. This program provides significant tax benefits to

In the realm of Italian real estate transactions, confirmatory deposits, or “caparra confirmatoria” as stipulated in Article 1385 of the Italian Civil Code, play a

In the realm of Italian law, two frequently confused terms hold significant weight: domicile and residence. While both concepts relate to a person’s connection to

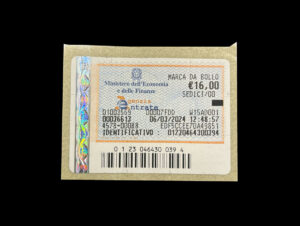

Navigating official paperwork in a new country can be a daunting task. In Italy, you might encounter the term “marca da bollo” and be unsure

So you made some money in Italy and it’s time to file your US taxes. How to handle foreign taxes you’ve paid or owe is

Can I have two Forfettario’s for two different types of businesses? No, it’s not possible to have two active forfettario regimes in Italy under the

Taxation on international dividends can be a complex web of regulations and treaties, often leaving taxpayers scratching their heads. However, a recent landmark decision by

In Puglia, Italy, where ancient traditions and modern conveniences coexist, the role of a notary is of paramount importance. The notary’s functions extend far beyond

The Italian tax system can be a labyrinth of regulations, forms, and obligations, especially for individuals who rent their properties on platforms like Airbnb. Fortunately,

Navigating the complex world of taxation is a challenge for small businesses and self-employed individuals in any country. Italy is no exception, but it offers